Something I've noticed for a long time played out yet again the other day...

Early Friday morning (October 25th) an important technical pattern triggered on bitcoin.

A pattern known as a "Death Cross".

It has an ominous name and is often quoted by traders as an extremely bearish technical indicator/pattern.

Specifically, it is where a faster moving average, usually the 50 period MA, crosses below a slower moving average, usually the 200 period MA.

It triggered early Friday morning on bitcoin:

(Source: https://www.coindesk.com/bitcoin-charts-death-cross-after-47-price-drop-from-2019-high)

What happened next?

Well, unless you have been living under a rock the last couple days, you know very well what happened next.

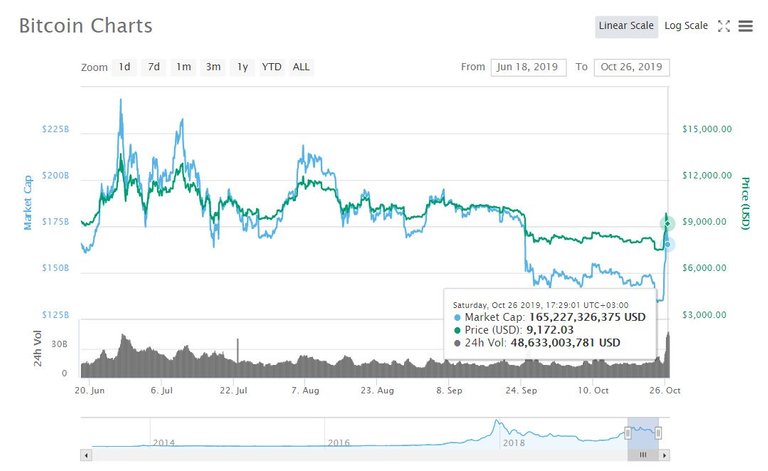

Bitcoin spiked some 40% in a 24 hour period!

Briefly touching highs over $10,500 per coin after being below $7,400 just a day before.

Not only that, but bitcoin saw record breaking volume in the process:

(Source:

Bitcoin saw $48.6 billion in dollar volume on October 26th, which was a new all time high since bitcoin was created over a decade ago.

The previous all time high was $46.4 billion on June 27th earlier this year.

And this started on a very day that this supposedly extremely bearish technical pattern triggered.

A bearish pattern you say?

I have noticed throughout my years of trading that the Death Cross is so much of a lagging indicator and it happens after an asset is already so beat up, that it often signals a short term bottom at the very least.

And possibly an outright entire trend reversal.

In fact, I am not the only one that has noticed that.

Check this out:

(Source: https://www.coindesk.com/bitcoin-charts-death-cross-after-47-price-drop-from-2019-high)

The same thing likely happened here.

We had sentiment at such extremes that it didn't take much pushing in the other direction to get a massive snap back rally, right at the time when things were starting to looking their most bearish.

Stay informed my friends.

-Doc