INTRODUCTION

It has been two years since Crypto derivatives have been seen a potential growth and the mass focus on spreading futures adoption where they wins the heart of various investors and chooses digital currency rather than other foreign currency and precious metals. BTSE Exchange has been one of the most watch Cryptocurrency Exchange this year and now attempting to lead the charge. It's Pitch was on the news and buzzing the Crypto Sphere whispering "It's Time Switch". Infact, BTSE just stoled the position of fourth-largest cryptocurrency by market capitalization for spot trading on July 29th. Well, They are kinda new, will it's Pitch can rule them all? Who knows? Then, Let's dive in.

.jpeg)

source

Originally Founded way back in 2018, BTSE Exchange officially launched it's market just in 2019. It's Multi Digital Currency Exchange Offering the most latest feature that a Cryptocurrency exchange must have but only few can adopt, it includes; futures trading, spot trading and multiple fiat on- / off-ramps.

BTSE UAE is licensed by the Department of Economic Development, Government of Dubai and is under the regulations of the Central Bank of United Arab Emirates. BTSE is led by by CEO Jonathan Leong, Co-Founder Brian Wong, COO Joshua Soh and CTO Yew Chong Quak Together with traditional and software financial services professionals all the way from giants like Goldman Sachs, IBM and Cisco, the exchange offers a cutting-edge services for institutional and individual traders.

.jpeg)

BTSE CEO, Jonathan Leong source*

The BTSE Co-founder and CEO, Jonathan Leong pinned down the company Goal is to make bitcoin reasonable for anyone by minimizing the volatility of bitcoin by means of allocation of liquidity.

“I wanna make bitcoin affordable for anyone.”- Jonathan Leong, CEO of BTSE

Diving in to BTSE features. Two Door in one Room.

BTSE Exchange has a two different page options that can be both use for trading but they are completely different, labeled the futures and the spot trading.

Differences Between SPOT and FUTURES

FUTURES 2.0

Their pitch "Personalized your trade" was connected on its Futures 2.0, where it is one of the most standout Feature of them. Unlike on traditional crypto derivative exchanges where all of the trading (posting margin, or closing position) was done through BTC, BTSE's upgraded Futures 3.0 allow it's traders to post a margin with several currencies and coins simultaneously, and to reconcile transactions by any combination of traditional fiat and Cryptocurrency they've chose that is supported on the platform. It currently supports stable coin USDC, TUSD and USDT, supported crypto including BTC, ETH, LTC, and XMR, and multiple currencies USD, EUR, GBP, JPY, CNY, HKD, SGD, MYR and AED. BTSE exchange offers Up to 100x leverage in Futures and currently have a first deposit bonus when you deposit $1k or above, plus they also have $10 Retweet bonus, you can found more details on their Bonus Checklist.

The exchange also uses Linear Contracts which allows the trader to predict exit points, minus the complicated calculations posed by the other types of contracts.

BTSE’s futures exchange is really got too far, with it’s Bitcoin perpetual 24hr volume regularly hitting more than $50 million, while its Ethereum perpetual about $2 million traded every day.

BTSE is one of the first Cryptocurrencies Exchange in the world to offer Monero futures trading. As per announcement, KYC is not even required for users, BTSE also offers an up to 100x leverage on futures.

In other words, you really have the ability to personalized/ customized your trade. It's perspective is to bridging the gap between cryptocurrencies and the hundred-trillion global futures market, serving the purpose of growing the Cryptocurrency market while taking the non-cryptocurrency traders in the game. Click here for a guide on how to Deposit Into your FUTURES wallet.

SPOT MARKETS

BTSE SPOT Market Tutorial

BTSE also offer a traditional Spot Markets where as users can deposit USD directly from their Bank accounts.

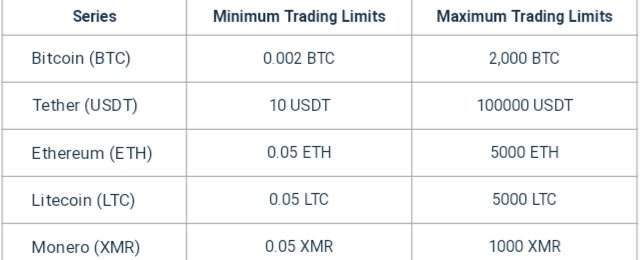

BTSE SPOT market currently offers 11 markets (5 standard trading pairs _ 6 indexes) Standard markets such as; BTC/USD, USDT/USD and ETH/USD, and also offers BTC, ETH, LTC and XMR index.

It sets the minimum spot trade size of 0.002 BTC, 10 USDT, 0.05 ETH, 0.05 LTC & 0.05 XMR, and a maximum of 2,000 BTC, 100,000 USDT, 5,000 ETH, 5,000 LTC and 1,000 XMR.

TRADING EXPERIENCE

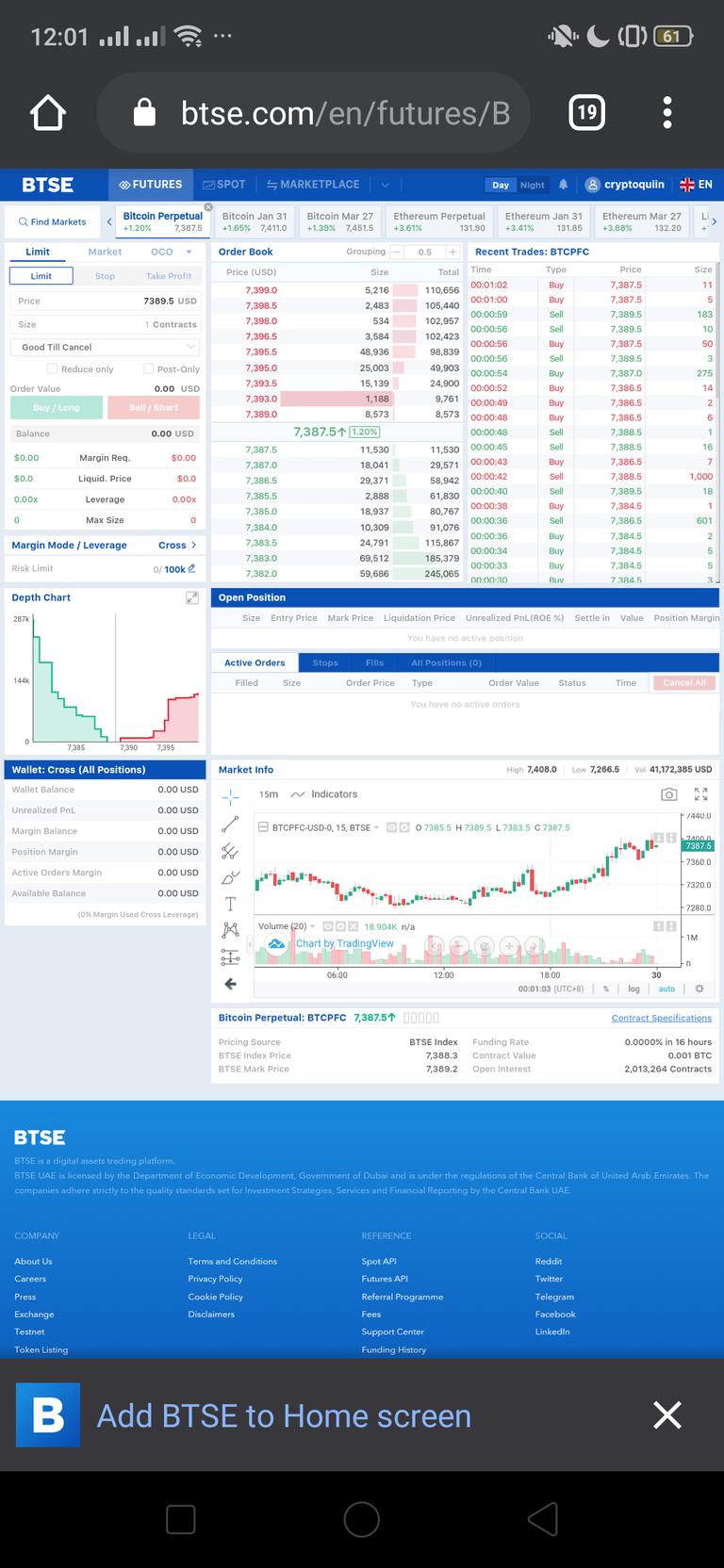

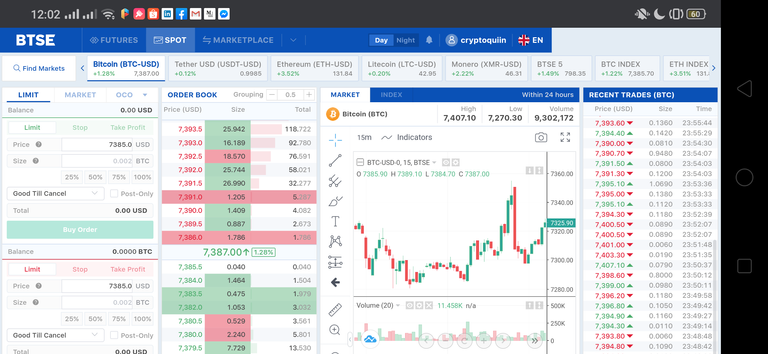

BTSE Futures Trading View On my Mobile Phone

BTSE Spot Trading View On my Mobile Phone

The Trading View of both SPOT and FUTURE trading page was hilarious, neat and smooth and as you can see, it has the most advance tools that the growing numbers of traders needed including broad charting tools, full range of order options, with stop and take profit orders, trailing stops and an index orders. Trading in BTSE platform is never be like on Bitmex or Bitfinex where users experience delays and overload issues, BTSE's Trading Engine can handle 1M order request per second (end to end).

Users can choose what currency to settle in for the PNL when trading on the futures contracts, by selecting this under the “Settle In” column. Example if you trade BTC Perpetual or Timed Based BTC Futures, you can choose to settle it in BTC, in fiat like USD, or stablecoins like USDT, USDC and TUSD.

In order to use the BTSE exchange with your fiat currency, Users need to undergo KYC verification before they can deposit/trade fiat. They must be at least 18, since BTSE is a regulated trading platform. After completing the Identity Verification, you can now trade without limit.

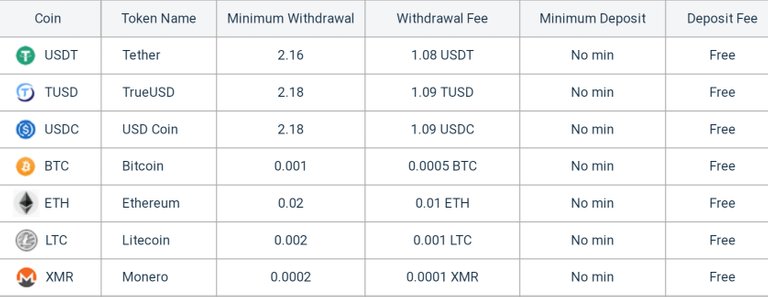

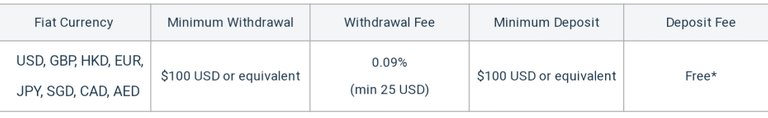

However, unverified traders can still deposit Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Monero (XMR), and stable coins—Tether (USDT), True USD (TUSD) and USD Coin (USDC). The advantage of Verified traders is they can deposit any of these currencies, with additional different fiat currencies, such as USD, EUR, GBP, and CNY.

BTSE's FEES

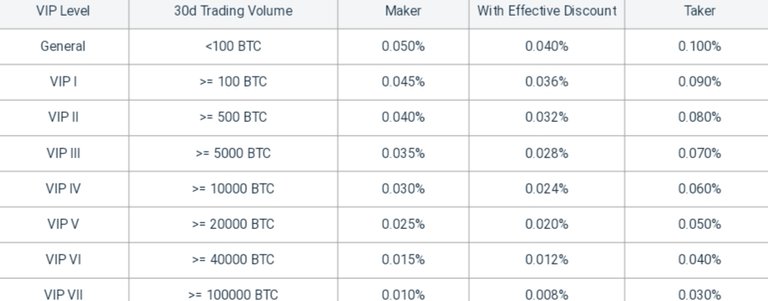

BTSE has a different fee structures for its spot and futures but it both employs a maker and taker fee model.

The users account VIP level is determined based on a one-month rolling window of trading volume, and recalculated once every 24 hours. In order to see the clients VIP level, they must log into their account and go to it's profile. The Trading volume was calculated in BTC terms while Non-BTC trading volume will be converted into BTC equivalent volume at spot exchange rate.

SPOT Trading Limits

Perpetual FUTURES Trading Fees

Deposit and Withdrawal Fees

Always make sure that you put a correct deposit/ withdraw Wallet Address, because once you depositing/ withdrawing digital currency into an incorrect address, your asset may loose and never be recovered. So always threefold check Wallet Address.

Author's Forewords

BTSE's whole interface satisfies me, it's website can access both in Mobile or PC. Their services is going wide as they also plan to have BTSE APP in January.

Furthermore, BTSE also provides an educational place that they called "BTSE Academy" which obviously what traders need, specially on beginners. They provided content designed to boost traders skills and knowledge, beyond regular news and general trading-related tutorials. Anyway, what I was really looking forward to this exchange is, their CEO itself was active on Twitter! I mean, you can easily reach to the CEO, and it is reflected as the transparency of the platform.

There's a Lots of new features coming to BTSE soon, meantime, I suggest you to go visit their Exchange you can use my referral link if you do not have an account yet. My bad Before cutting this article, I'm gonna tell you that BTSE offers a Loyalty Program. Please do refer to this for more details.

Overall, BTSE is boosting their features, it's pitch is obviously a real deal for the users. No surprise that it's always on the news now, getting stronger with new products coming.