Ever since my post last week about the incoming EOS competitor to STEEM to be called MEOS, most of my thinking about blockchain and cryptocurrency has been directed towards the conundrum of how, in the long run, to effectively distribute a token's supply. There's a lot left to think about, but I thought I'd document where I'm at for the moment in hopes of getting some feedback from the awesome STEEM Community.

What do we really mean by decentralization?

The two definitions of the word "decentralization" are:

- The transfer of authority from central to local government. As in the following examples,

- ‘efforts to promote decentralization and reform of the national political party’ or

- as a modifying adjective in a phrase such as ‘the government's decentralization program.’

- The movement of departments of a large organization away from a single administrative centre to other locations. As in the following examples,

- ‘the decentralization of business services’ or

- ‘Kiltimagh is the ideal location for decentralization of IT type projects.’

The obvious takeaway from this basic definition is that when civilians (you can call them no-coiners if you like) talk about decentralization, they are talking about the decentralization of 1. governance and 2. resources. That's it! The distribution of token supply should not be discussed when we talk about decentralization.

That being said, an examination of this definition reveals the most important characteristics when analyzing any blockchain-based economic system. Outside of the OG blockchains like bitcoin, litecoin, and to a certain extent FLO, most of these blockchains are so young that it benefits the designers of new blockchains to consider both the means and the degree to which these systems address:

- governance

- resources

- token distribution

Since these three characteristics are maybe a lot to include in one singular concept, and since I am not German enough to bring it all together in one sublime gargantuan word, as Arnold Schoenberg once did with his concept of klangfarbenmelodie in 1911, but still stupid enough to try, we might want to call the systems that we are currently playing at creating crypto-microeconomies.

Greed Dominates the Early Stages of Any Crypto-Microeconomy

One of the most tiresome aspects of the blockchain industry is its seemingly endless tribalism. In my opinion, this current characteristic is simply reflective of how early we are in the development of this burgeoning governance/technology/economy. To emphasize this point, I very much like the distinction presented in this article, "Institutional Cryptoeconomics: A New Model for a New Century", between general purpose technology and institutional technology. Yes, blockchain, like the steam engine is a game-changer of a general purpose technology, but it is also an institutional technology. And it is one that can entirely reshape the meaning and structure of both our public and private institutions.

In the finance world, we dismiss such tribalism by just saying that so and so is "talking their book." A bitcoin maximalist is most likely that, well, because he holds the private key to a lot of BTC. A proponent of Ethereum touts its long-term prospects, most likely, because he or she bought ETH under $10. EOS people, well, they bought a lot of EOS early on in the 365-day ICO cycle of @dan's project.

That's understandable. People are, by their very nature, greedy. That's why it's the basis of liberal economics. People, on the whole, nearly always act in their own self-interest. This impetus may get redirected, at times, due to competing loyalties to family, nations, etc. But the most logical assumption we can make, and the one we have mostly made since 1776, is just that. People are greedy. Our current economic system is literally built upon this fact.

As Milton Friedman famously said, and I maybe too often quote, "The business of business is business."

Everything else in a capitalist economic system should proceed from this rationale.

The Economics of the Tech Economy

From my perspective, the point of blockchain-based economic systems, or what I'm going to start calling crypto-microeconomies for brevity's sake, is to corral that notion and use it for good. Essentially, a system developer should aim to take Adam Smith's "invisible hand" and almost effortlessly point it towards maximizing society for all rather than maximizing profit for some.

In the new world of digital-oriented economies, this notion is paramount. Classical liberal economists have for centuries thrived on adjustments based on signals due to various, and often slight, inefficiencies recorded in reaching, or striving to reach, some equilibrium point. The relative equality of such a system lives somewhere in the midst of all those forever slightly changing adjustments.

But we now live in a world where adjustments in price and consumer behavior can happen almost instantaneously. The proliferation of "sharing economy" platform businesses has largely been behind this transformation. I'm sure you've seen this comment before: The largest transportation company owns no cars (Uber). The largest travel company owns no hotels (Airbnb). The largest media company does not make its own media (Facebook). And on and on... These platforms are merely honeypots for data aggregation. The platform owners then use that data to optimize their platform (in order to maximize profit for some, i.e. their shareholders), which then leads to more data, which leads to better optimization, which then leads to more profit, etc. etc. Boom! Network effects leads to scale and, eventually, monopoly.

Such is the curse of modern capitalism. In an era of brutish competition, it works rather well. But in the long run, the goal of every "business doing business" inevitably leads to monopoly, which then squeezes out the competition that provides the fuel for the efficient running of the capitalist machine. That's why the US and Europe have so fiercely gone after the monopolies that they have observed in the past. Standard Oil, AT&T, Microsoft, etc.

But as the nature of politics changes (and corporations co-opt the system within which they operate) and while also the nature of competition itself evolves (from one of price competition to one of data-access competition), it becomes much more difficult to go after monopolies as they occur in real time. Plus, as the tech-based modern economy moves at the speed of Moore's Law (every 18 months we get twice the capability for half the price, on average), tech behemoths emerge and become gargantuan at an ever-quickening pace, making effective regulation almost impossible.

Getting to the Proper Dialectic

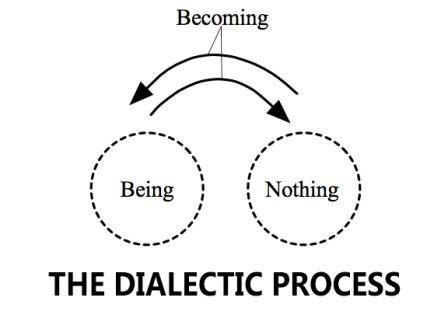

From a dialectic perspective, we are spending more and more time in the black-and-white areas of "being" and "nothing" and less and less time in the more intellectually fruitful gray periods of "becoming." Without the stimulating pursuit of refinement of an idea, we get stuck in our little ruts of Team This or Team That. The few people in this world that would be advocates for the advancement of crypto-microeconomies get forced into roles for Team Bitcoin or Team Ethereum or Team Grin or whatever it is we happen to be holding a bunch of at the moment.

Obviously, that's really bad for Team Crypto. This fracturing allows the elements of the industry with access to the most crypto capital to manipulate prices even further in their favor. Thus, perpetuating the inequality of crypto ecosystems and forever feeding the anti-crypto argument posited by the likes of Nouriel Roubini, who actually testified before the US Senate on October 11, 2018 submitting a document titled "Crypto is the Mother of All Scams and (Now Busted) Bubbles While Blockchain Is The Most Over-Hyped Technology Ever, No Better than a Spreadsheet/Database". I have no idea why we keep in-fighting amongst ourselves (well, actually, I do. It is just greed.) when these are the kinds of things that are trotted out as arguments against bitcoin, blockchain, and crypto with regularity.

The most recent example of whales acting for the profit for some over improving society for all was the obvious "borrow and short" BTC flash crash on Bitstamp on Friday, May 17, 2019.

There were rumors on the scene for weeks of a certain actor gobbling up a bunch of BTC while willing to pay a significant monthly interest rate. This is such a basic finance move (borrow an asset, short it with leverage, sell the asset at market, then buy the asset back at lower prices) that I'm surprised we haven't seen more of this kind of manipulation already. The end result, however, is now we have an even more skewed distribution of BTC. But notice how I do not say, "Now we have an even more centralized BTC supply." That's just not the proper dialectic.

For governance and resources, I think the proper dialectic is between "centralized" and "decentralized." Having defined this relationship properly gives us the correct perspective on what actions lead to the "becoming" of the system.

However, with regard to token supply, we must define the dialectic as between "concentrated" and "distributed." With this proper perspective, we can evaluate the influence of our actions on each crypto-microeconomy more precisely.

Great! Now that we've cleared up those semantics, I think we can move on next time to how exactly one might achieve a properly "distributed" token economy. And no, I don't think the answer is airdrops! 😉

Thanks for reading and...

As always, PEACE! ✌🏼