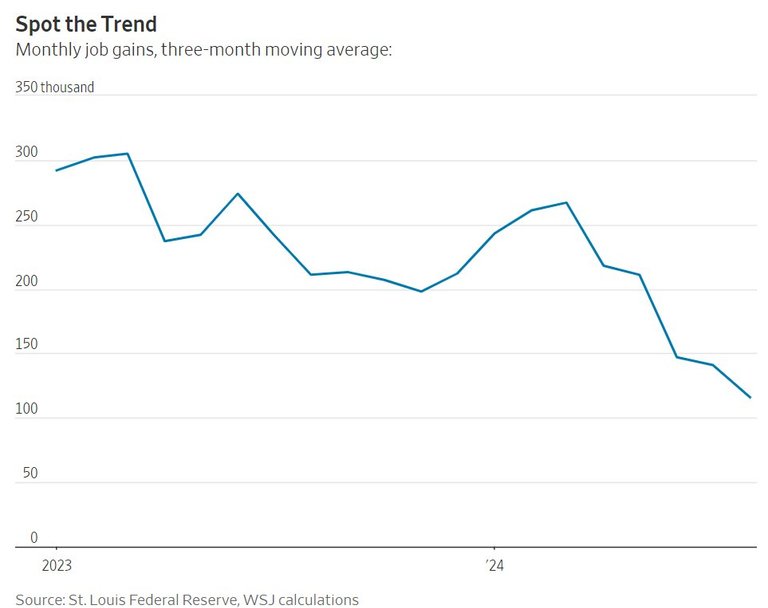

The Fed has a dual mandate; low inflation and low unemployment. Sometimes the data on job gains gives you a clearer picture than the unemployment rate (which only counts those actively looking for jobs but can't find one). Take a look at the following chart which plots a three-month moving average of monthly job gains (the average smoothes the noise of monthly spikes or dips):

The trend is clear; job creation is slowing as businesses struggle with rolling over their debt in a high interest rate environment.

High interest rates always force businesses to become more efficient, and that is a good thing. But if you stress businesses too much, you get job cuts, and that is where the American economy is now.

So the Fed is going to cut rates, the question is by how much, 25 basis points or 50?

I think it might be 50 basis points. Bear in mind they won't want to do anything in October as that is too close to the Presidential elections. Next week is their only chance to make a move.

So they will cut by 50 basis points and hope the inflation data doesn't turn upwards leaving them with egg all over their face.