Reviewing the Heart of Sustainability

Welcome back to our Series, Into the Heart of Sustainability. Last week we did a review of the most important of our math basis posts - we are very happy with how far we have come in explaining the inner workings of the SBI program!

This week we are going to take a slightly different tack - to show how sustainability depends as much on legal definitions as it does on the underlying mathematical structure, and how the program was designed to respond to the outstanding legal environment and assure a level of legality.

Do You Know what Steem Basic Income is?

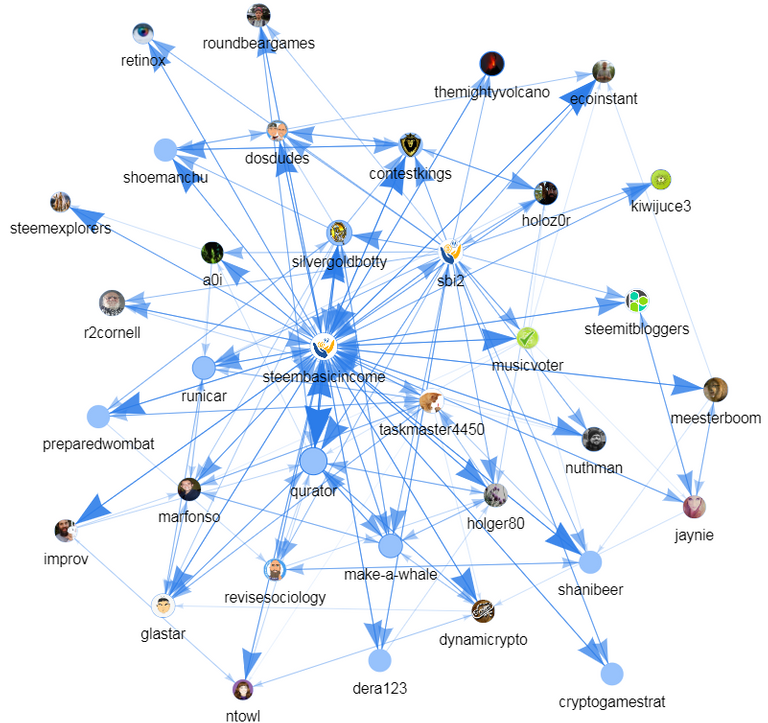

Steem Basic Income is a social experiment to bring a basic income to as many Steemians as possible. Members join by sponsoring others into the program. Steem Basic Income is delivered through providing regular upvotes to member content.

Legal Terminology

You may have noticed that we make quite an emphasis on the use of the term units over the term shares. SBI, as well as many things in the crypto realm, could be in a legal grey area as a new class of technology, and we have made careful decisions about how we designed our service because of that.

We could have designed a subscription service, sold shares in a proof-of-stake mining pool or marketed as an investment in an income scheme, and each would be treated very differently by various government organizations around the world. The rights and obligations that members have, plus the rights and obligations that our service would have, also change depending on the design.

We have seen an explosion of projects on Steem Engine, which on the one hand is very good because it shows that our community has great ideas and lots of spirit. On the other hand, we are very skeptical of any project that claims to have a ‘value basis’, because these tokens could be illegal to sell to any users in the U.S. who are not accredited investors.

Steem Basic Income ‘units’ represent a subscription level to our upvote service; this helps prevent being classified as a security and allows participation from all levels of users from around the world. If we release a token, would this definition hold up? Can a subscription be both transferable and fungible? Legally, treatment as a subscription is much easier to maintain while remaining centralized. As a subscription service, we can also continue to exercise some level of quality control by using a blacklist, denying service to questionable accounts, and using other such strategies.

We only deliver upvotes, and those upvotes may or may not have value. We are not in control of market forces or outside flags, nor the reward pool nor the protocol-level mechanics. Some members have asked for wallet transfers instead of upvotes if they don’t post, but we can not do this because that would clearly convert us to a class of security (and possibly a ponzi, depending on where that money would come from).

We currently have 4800 active members receiving votes at least once per month, and two-thirds of those never enrolled themselves: they were sponsored by others. With equity shares this would not be possible, and might even be illegal.

Sustainability is about more than just math, there are real-world legal implications and risks to consider. Designing ourselves as a subscription service instead of an equity or financial contract is a big part of what makes our program sustainable. These issues of definition affect tax treatment, legal rights and many other factors behind the scenes.

The laws and their interpretations are still being developed by those in power and could change, but we want you to know that being a subscribing member of @steembasicincome is completely legal, and we will work to keep it so - by avoiding changes that increase legal uncertainty and considering potential legal implications with any new changes.

Disclosure: This provides our perspective on the current regulatory environment, and describes some of the efforts we have made to ensure compliance. This is not intended to be legal or financial advice. You should always consult your own financial and legal advisers before making any monetary commitments- whether subscription, investment, token-purchase, drug production upgrades, or whatever!

Writer Bio

This Sustainability report was prepared for us by @ecoinstant.

From a young age, @ecoinstant continues to be very interested in the mechanisms of sustainability, and loves being a part of several teams working on promising projects, including the marvelous Steem Basic Income!

Questions?

Please read our FAQ. If you still have questions, ask in the comments section or join us in our discord channel.

You can look up your current membership levels by using !sbi status in a comment or post, or the similar tool that we have in our Discord server