Info from taxfoundation.org would seem to contradict this, at least to some degree:

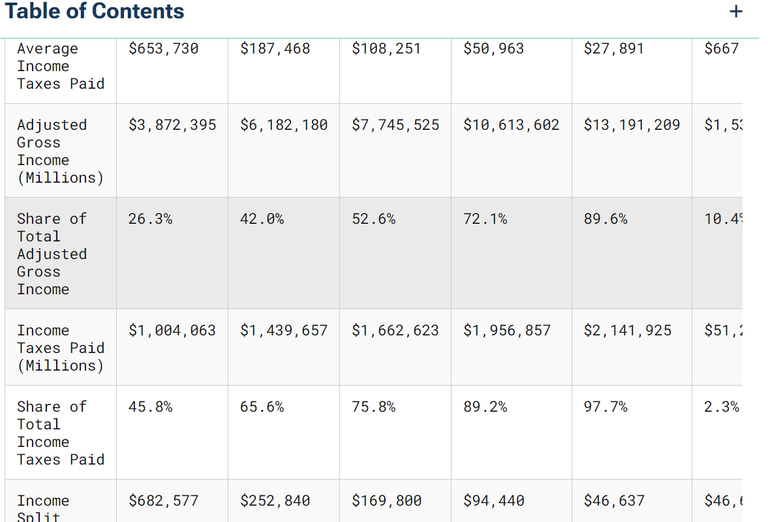

The average income tax rate in 2020 was 13.6 percent. The top 1 percent of taxpayers paid a 25.99 percent average rate, more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers.

The top 1 percent’s share of federal income taxes paid rose from 38.8 percent to 42.3 percent in 2023.

The top 50 percent of all taxpayers paid 97.7 percent of all federal individual income taxes, while the bottom 50 percent paid the remaining 2.3 percent.