I like to keep up with DEFI options outside of Hive, and I have a softspot for the Polygon network given the ETH base and cheap fees.

It's beena while since I checked out what's on offer, and the results are... reasonable, without being outstanding (compared to Hive!)

The overall picture is that according to DefiLlama Polygon has around $850 million locked making it the sixth in terms of TVL, after ETH, BSC, Arbitrum, Solana and Optimism. (We disclude Tron because it's one giant exit scam).

Selected returns on some of the better known vault and aggregator platforms...

Aave has the following options:

- USDCe AT 5%

- Wrapped BTC at 0.2%

--

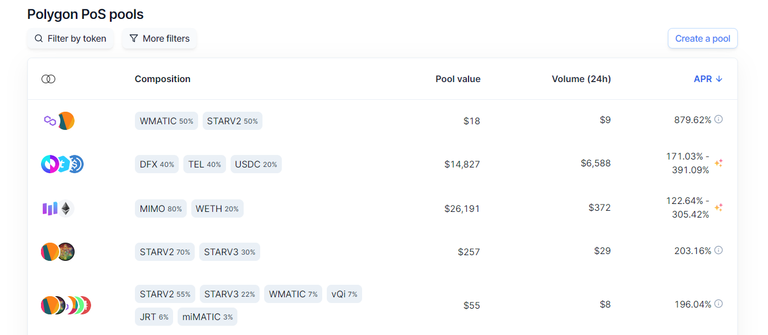

Balancer has a much wider range of options:

- A 4 way stable pool at 0.8%

- WBTC-WET at 0.3%

- WBTC-WETH-USDC at 1.82%

- And a range of recogniseable token pools at around 5%

It also has some CRAZY, almost certainly unsustainable options...

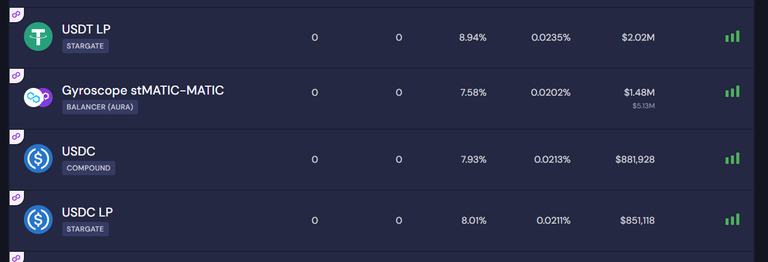

Beefy Finance appears to have some good options with...

- A couple of stablecoin vaults at around the 8% mark.

- What seems to be 6 token pool incorporating BTC-ETH and stable coins, at >40% APY, but this seems to be too good to be true.

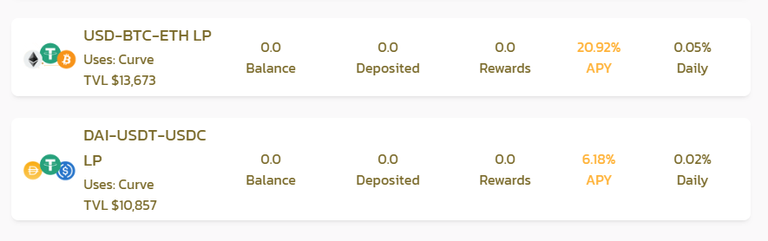

PolyCub actually comes out the best, but with only TWO options...

- the stable tri pool at 6%

- WBTC-ETH-USD at 20%

DEFI Options on Polygon final thoughts...

While the chain isn't dead with almost $1BN locked, it is falling behind, so I'd be reluctant to stake thousands of dollars worth of crypto to it, my fave choice would be Polycub as I know it but with only 5 figures pooled in each of the only two options, that's not particularly attractive either!

I think I'll stick with Hive, and Thorchain!